What Is A Living Trust And Why Does Everyone Need A Living Trust

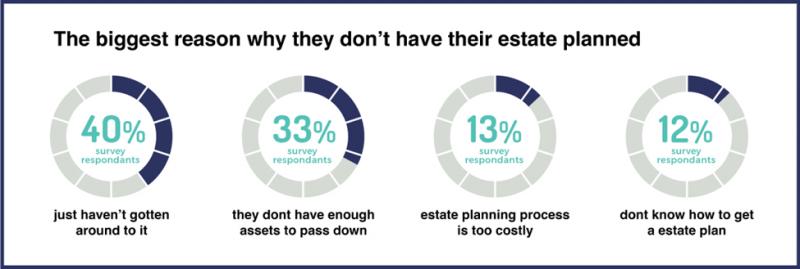

Estate planning is something that many people put off for as long as they can. Sometimes, it’s deferred until it’s too late. The general feeling is that it’s only for the super-rich or that it’s too complicated and time-consuming. Often, people put it off because they don’t like the idea of contemplating their own death.

However, estate planning is not all about death. It’s mostly about taking charge of your own estate, however small or big. A living trust lets you control what happens to your property both during your lifetime and afterward.

What Is A Living Trust

A living trust is a legal document that lets you determine how your property and possessions will be distributed among beneficiaries after your death. It’s designed to make the process of transferring your assets to people and organizations you designate easier. A living trust also lets your family and loved ones bypass probate - a complex and expensive legal process that oversees the distribution of a person’s assets after their passing.

You can put almost all assets into your living trust, including your home, bank deposits, jewelry, art, stocks, insurance policies, and even your collection of stamps or autographs. It also allows you to appoint a custodian to manage what you leave to your minor children. In essence, a living trust becomes the ‘owner’ of your assets while allowing you to maintain full control over them.

What Are The Differences Between A Living Trust And A Will

Both living trusts and last will and testament allow you to determine who receives your assets after you’re gone.

The most important distinction between a living trust and a will is that the latter goes into effect after death. A living trust, on the other hand, lets you control your assets both while you’re alive and after. This feature is highly reassuring for several older Americans and their families.

Furthermore, because a will offers no protection if you become physically or mentally incapacitated, a court could easily take control of your assets while you’re still alive. A living trust avoids this nightmare scenario by allowing you control over your assets even if you were to become incapacitated.

There are many other differences between a living trust and a will:

- A living trust avoids the lengthy and expensive process of probate that a will must go through to be validated.

- It protects individual privacy as trust proceedings are usually not public, while probate proceedings are.

- You can create a ‘joint living trust’ with your spouse or partner. This can help you protect each other’s interests as well as your beneficiaries’ interests.

- Compared to a will, beneficiaries of a living trust are likely to receive their inheritance much more quickly.

- Subject to state laws, a living trust can also mean a substantial reduction or even elimination of estate taxes.

- Unlike wills, living trusts are difficult to contest in court.

- Living trusts are comparatively inexpensive, easy to set up and maintain, and can be changed or canceled at any time.

- A living trust can protect minor children, dependents with special needs and even govern the care of pets.

One frequently asked question is whether you need a will even after executing a living trust. The answer is yes, you may need what is known as a ‘pour-over’ will. This is a safety net to cover assets that you may have forgotten to include in your living trust. In such cases, the assets need to go through probate first before being distributed.

Source: https://www.cnbc.com/2022/04/11/67percent-of-americans-have-no-estate-plan-heres-how-to-get-started-on-one.html

Types Of Living Trusts

There are several types of living trusts, but they all fall into either of two categories: revocable and irrevocable.

Revocable Living Trust

Revocable living trusts (RLTs) are the more flexible type, allowing you greater control of your assets and how you choose to distribute them. With an RLT, you can revoke or cancel the trust at any time you want. You can also add new assets to the trust and change, add or remove. RLTs further allow you to change trust guidelines or sell off trust property entirely or in part.

As a grantor, you can name yourself as the initial trustee of the RLT, claiming full control over your assets while you’re alive. All it requires is that you name a successor trustee who will manage the trust after your passing.

Your trust will become irrevocable after death, meaning that it can no longer be canceled, changed, or amended in any way. Your designated successor trustee will simply have to follow instructions in the trust document to distribute your assets as you intended.

RLTs are a popular option because of the flexibility they provide. However, they are subject to estate taxes upon your passing. Living revocable trusts are also subject to creditor claims and lawsuits. That means any debts or settlements you owe at the time of passing can be realized from your trust.

Irrevocable Living Trust

This type of living trust is less commonly used because of its inflexibility. They are mostly used by very high net worth individuals to minimize estate taxes and avoid potential creditor claims.

An irrevocable living trust (ILT) is one that you cannot cancel or easily change. Just like in an RLT, ownership of your property transfers to the trust once it has been executed. But once that is done, you no longer have full freedom to make changes. Amending an ILT requires the trustee to first come to a signed agreement with all of its beneficiaries. In certain cases, changes to an ILT require a judge’s approval.

Assets put in an irrevocable living trust are no longer part of your taxable estate, which means there will be no estate taxes due on it when you pass away. Irrevocable trusts are most beneficial to those who are worth more than the federal estate tax exemption limit of $12.06 million for individuals, and $24.12 million for married couples.

What’s Best For You

What type of living trust is best for you depends mostly on your net worth. There are pros and cons for both. Revocable living trusts are more common because most American estates are worth less than the federal estate tax exemption limit. Plus, you’re free to continue managing your assets without restriction after you’ve established the trust. Making changes is easy with RLTs and the transfer of assets to heirs is quick and private.

Irrevocable trusts are a better option if you want to avoid estate taxes. They offer several benefits like protection from lawsuits and creditors. You should consider them only if you’re comfortable giving up control of your assets once the trust has been established.

How To File A Living Trust

The prime motivation behind creating any kind of living trust is usually to avoid probate. But how do you go about setting one up?

A living trust is one of the least complicated estate planning options available to you. It’s always best to hire an estate planning attorney to take you through the process, but you can get about creating a simple trust yourself. Whichever way you go, the following are the most important decisions you’ll have to take beforehand:

- Individual or shared: You can choose to set up either a shared trust or an individual trust, depending on your conditions and preferences. If you live with a spouse or a partner, a shared trust will help you jointly control your assets. The other option is setting up two individual trusts.

- What to include: First prepare a comprehensive list of all the assets that you own. It may not be worth putting all of them into a trust, just what’s most valuable. The general rule is to include all items that would otherwise go through probate to get the most out of your trust.

- List of beneficiaries: The next important consideration is deciding who inherits your assets and in what proportion. The usual beneficiaries are family members, friends, charities, and organizations. It’s a good idea to mention alternative beneficiaries in case one of them happens to pass away.

- Successor trustee: Any living trust must name a person as ‘successor trustee’ to oversee the eventual distribution of your assets. You can also name a trust beneficiary to receive final ownership of your trust. In either case, make sure they are willing to shoulder the responsibility.

- Adult manager: If your beneficiaries include minor children, you should ideally name an adult in your trust to manage their inheritance until they are of legal age. The Uniform Transfers to Minors Act (UTMA) allows you to name someone as property guardian or custodian for this purpose.

Once all the above decisions have been taken, you can get started with executing your living trust with the following steps:

- Preparing the document: The trust document is known as the Declaration of Trust. You should ideally hire a living trust attorney to draw up an accurately-formatted document that meets all your requirements. You can also get the trust document prepared through specialist online service providers.

- Signing and notarizing: Once the trust document is prepared, you must sign it in front of a public notary. For this, you will need to show evidence of identity. The notary will watch you sign the trust document before putting their signature and date to it.

- Transferring the title: A living trust is valid only when you hold title to all assets contained in it as a trustee. This involves transferring assets into the trust and changing the title as applicable. Ignoring this step will make your living trust ineffective.

- Storing the trust document safely: The final step of the process is storing the trust document in a safe place. There are no requirements to file it with any court or government agency. Keeping it in a bank locker or a fireproof safe at home is sufficient. Remember to inform your successor trustee where to find the document when it is needed.

How To Create A Living Trust

Whether you have a complex estate or a relatively simple one, you must have an effective living trust document - correctly formatted and without loopholes.

One way of doing that is through legal tech companies that let you create the document online without necessarily having to hire a lawyer. The pros and cons associated with this option are as follows:

- Pros: This option works out to be comparatively cheaper than hiring an attorney.

- Cons: They do not offer much protection if the trust happens to be challenged in court. In such a situation, you will need to hire a lawyer to represent you.

The safest way of creating a living trust is to consult an experienced estate planning attorney like Max Alavi. This is how the latter options stack up against the cheaper legal tech company alternative:

- Pros: You have more protection and your trust is less likely to be challenged. Even if that happens, you’ll have the option of representation.

- Cons: You’ll have to pay a fraction more money in exchange for better protection.

How Much Does A Living Trust Cost

Max Alavi has a simple but competitive pricing structure that provides flat fees on most living trust documents. The rates are:

- Individual trust: starting at $995

- Joint trust: starting at $1395

Why Hire Max Alavi As A Living Trust Attorney

Living trust documents prepared by Max Alavi combine the convenience of the internet with the confidence of having an experienced attorney by your side. You should hire Max Alavi because he:

- has over 28 years of experience in living trusts and estate planning

- has an excellent track record with a long list of satisfied clients

- is also a litigation attorney, well versed in living trust and estate planning litigation. Trusts prepared by Max are less likely to get challenged in court. Even if they do get challenged, they are less likely to succeed.

- is relatively affordable, considering the expertise and peace of mind he brings to the table.

More to Read:

Previous Posts: