Charitable Remainder Trusts – Higher Tax Deduction While Interest Rates Are High

You are lucky: All these capital gains!

You have been lucky, perhaps you have invested in any number of high-flying stocks, but your portfolio is overly concentrated (not diversified). The price-earnings ratios are astronomical, and you worry “How long will this last. Is it time for profit-taking and diversifying firm-specific risk away?”. Well, given this scenario, you probably have a lot of capital gains, and, before diversifying you would have to cash out to have the funds to reinvest in a broader market index, and you would be liable for a hefty tax bill. What to do?

You are a shrewd investor and a good person

Let’s assume you are not greedy. You are grateful, you are thinking about doing some good. You would like to make sure you are not spending it all at once, perhaps leaving something for charity. Here is your solution: A charitable trust, specifically a charitable remainder unitrust, going by the wonderful acronym of CRUT.

A CRUT is not crud

A Charitable Remainder Unitrust (CRUT) is a type of charitable trust that allows you to convert a highly appreciated asset into a diversified income stream, receive a tax deduction, and ultimately benefit a charity of your choice. It's a tax-exempt arrangement that pays a percentage of the trust's value, recalculated annually, to you or other named beneficiaries for life or a term of up to 20 years, with the remainder going to charity.

The Government is here to help

Income Tax Deduction: When you fund a CRUT, you may receive an immediate income tax deduction for the charitable portion of the trust's value. We will talk more about how much later.

Estate Tax Savings: The high estate tax exemption, in 2024 $13.61 Million, will sunset by the end of 2025, to half of that amount unless Congress acts. More estates will therefore be subject to federal estate taxes. Assets that you transfer into the CRUT are removed from your estate, potentially reducing estate taxes.

Avoid Capital Gains Taxes: By transferring appreciated assets (your few high-flying stocks) into a CRUT, you avoid paying capital gains taxes when you diversify into a broad index or a basket of stocks. Usually, you would sell the stocks, pay capital gains, and reinvest. With a CRUT no capital gains taxes are due on sale, allowing the full allowing the full sale proceeds to be reinvested, in your case from a few high-flying stocks into a broader market of your choice.

Income Stream: The CRUT provides an income stream to you or other beneficiaries for life or a specified term. The payout rate is a fixed percentage of the trust's annually revalued assets. As long as the average annual growth exceeds the payout rate, the value of the trust assets grows. This increases the payments you receive and the ultimate value to the charity.

In other words, when your payout rate percentage is lower than the annual growth of your investments, your payouts are going up. Because you did not have to pay capital gains, there is more basis in the trust to grow from.

Charitable Contribution: After the income interest period ends, the remaining trust assets go to your chosen charity, supporting your philanthropic goals.

How CRUTs Work

Funding the Trust: You transfer appreciated assets into the CRUT.

Tax Deduction: You receive an income tax deduction in the year you fund the trust, based on the present value of the remainder interest that will eventually go to charity. This present value is calculated with the so-called section 7520 rate (explained below).

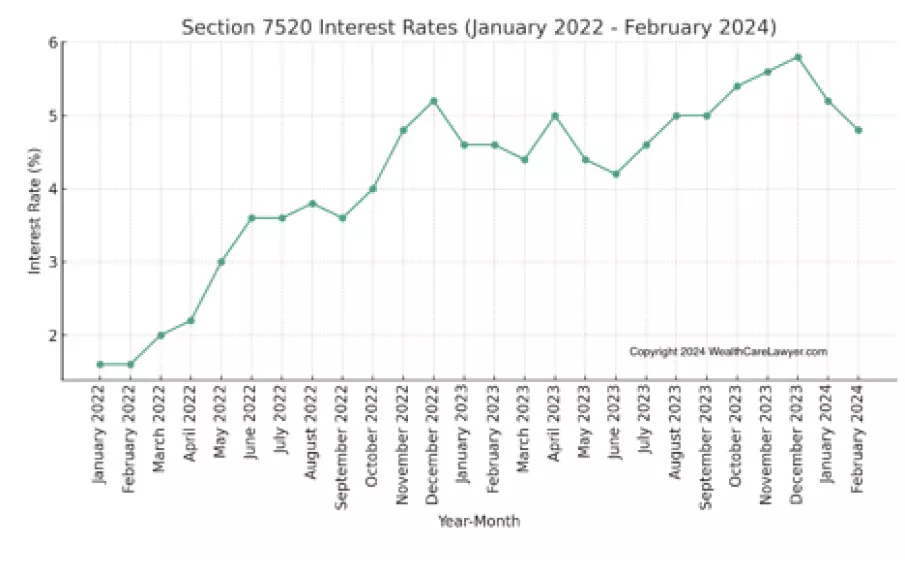

Figure 1: The Recent History of Section 7520 Interest Rates

Income Payments: The CRUT pays a percentage of its value (5% - 50%) each year to you or another beneficiary.

Charity Receives Assets: After the termination of the trust (either after a set term or upon the death of the last beneficiary), the remaining assets are transferred to the designated charity.

Ideal for High Interest Rate Environments: CRUTs are particularly attractive in environments of high interest rates because the initial charitable deduction and the income stream can be more favorable. The fixed percentage payout is recalculated annually based on the current value of the trust assets, which can be beneficial if the trust's investments perform well.

Understanding the Section 7520 Rate

The Section 7520 rate, sometimes referred to as the "federal discount rate," is a critical component in the valuation of charitable remainder trusts. It's used to calculate the present value of future payments that will be made by the trust. The IRS sets this rate monthly, and it reflects the time value of money based on current economic conditions. Critically, the higher the discount rate, the higher the initial tax deduction. Assume a Charitable Remainder Unitrust with a 20-year term, a 5% annual payout rate, and a $1 Million initial investment, but varying Section 7520 (discount) rates. The following illustration shows the relationship.

Figure 2: The Immediate income tax deduction goes up with increasing IRS Discount (7520) Rates

In periods of higher Section 7520 rates, donors can leverage CRTs not only to support charitable causes but also to maximize their immediate tax benefits, while still providing an income stream to themselves or other designated beneficiaries.

More to Read:

Previous Posts: